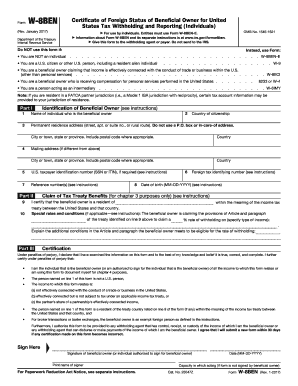

Get the free blank 2018 form w 8ben e

Get, Create, Make and Sign

How to edit blank 2018 form w 8ben e online

How to fill out blank 2018 form w

Who needs to fill out?

Video instructions and help with filling out and completing blank 2018 form w 8ben e

Instructions and Help about w8 bene form

Today we're going to talk about IRS Form w8 then certificate of foreign status of beneficial owner for United States withholding and reporting for individuals the primary purpose of Form w8 been is to establish that an individual is a foreign person that is not an u.s. person it is a relatively short form only one-page long, although the primary purpose of the form is to certify the foreign status of the individual the form can also be used to claim treaty benefits in part to w8 Ben should only be used for individuals and not for entities must fill out w8 Ben II as shown here and as shown here the term beneficial owner essentially means the owner of the income being received and that that person is not a nominee or an intermediary the terminology can get a little confusing because the person making the payment usually has a deductible expense and does not have income however it is income to the foreign recipient or the foreign beneficial owner the U.S. imposes a 30 percent withholding tax on certain types of payments of US sourced income to foreign persons the mayor of the income is obligated to withhold u.s. tax unless an exception applies the mayor is referred to as a withholding agent because the mayor may need to withhold u.s. tax the typical types of income that are subject to the withholding tax include dividends interest rents royalties and compensation for services however it is important to remember that it is only us source income that is subject to the 30% withholding tax in particular with regard to services if the payment is being made for services that take place entirely outside the US then the income is not considered us source income and the 30% withholding tax simply does not apply however it gets much more complicated if any of the services are performed in the US these withholding rules can get a little tricky however because you may be making a payment to an individual outside the US that happens to be a US citizen for payments to u.s. citizens you are typically required to send them a 1099 reporting the payment to the IRS in that case you ask the recipient for a form w-9 and forum w8 and then on the form w-9 they certify that they are an u.s. person, and they provide their US taxpayer identification number so that you can file the form 1099 payments to US persons can be subject to a 28 percent backup withholding if they don't provide their US taxpayer identification numbers, so it is important to understand that payments to US persons and payments to non-us persons can both be subject to potential withholding tax so how do you determine if an individual is a foreign person well you ask them to fill out a form w8 Ben where they sign certifying at the bottom they certify that they are not a US person if a person files form w8 Ben's certifying that they're not a US person and the circumstances change than the beneficial owner needs to notify the withholding agent within 30 days of the change in circumstances for example if the...

Fill pdf filler form w 8ben e : Try Risk Free

People Also Ask about blank 2018 form w 8ben e

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your blank 2018 form w online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.