Get the free w 8ben

Show details

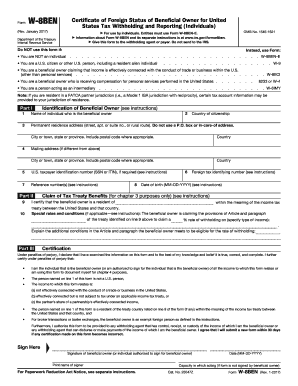

Version A, Cycle 3 Form W-8BEN-E (Rev. December 2012) Department of the Treasury Internal Revenue Service Certificate of Status of Beneficial Owner for United States Tax Withholding (Entities) OMB

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign w8ben form

Edit your w8 ben form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w8 ben form generator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w8ben generator online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit w 8 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w8 ben form

01

Start by gathering all the necessary information and documents that are required for the form you are filling out. This may include personal details, identification, proof of address, and any other specific requirements mentioned in the form's instructions.

02

Read the instructions carefully to understand the purpose of the form and the information needed in each section. It's important to follow the instructions accurately to ensure that your form is properly completed.

03

Begin filling out the form methodically, section by section. Use clear and legible handwriting or type the information if it allows for that. Ensure that all details are accurate and up to date.

04

If you encounter any terms or jargon that you are unfamiliar with, consult a dictionary or online resources to ensure you understand what is being asked. It's crucial to provide correct information to avoid any complications later on.

05

Double-check your answers and review the completed form for any errors or omissions. It's always a good idea to proofread your work before submission to ensure accuracy and completeness.

06

If there are any additional documents or attachments required to support your application or provide further information, make sure to include them according to the form's instructions. These may include photocopies of identification, bank statements, or other supporting documentation.

07

Once you have thoroughly reviewed and completed the form, sign and date it as required. Your signature signifies that the information provided is true and accurate to the best of your knowledge.

08

Finally, consider making a copy or taking a photo of the completed form for your records before submitting it. Keep track of any important deadlines or submission procedures to ensure your form is received on time.

Who needs to fill out?

01

Individuals who are applying for a particular service, benefit, or permission may need to fill out the form. This could include applications for passports, visas, licenses, permits, loans, or any other official documentation.

02

Employers or human resources departments may need to fill out forms related to hiring, employee onboarding, or tax obligations.

03

Students may need to fill out forms for college applications, financial aid, or course registration.

04

Anyone involved in legal proceedings, such as court cases or dispute resolutions, may need to fill out legal forms.

05

Individuals who are making a complaint or requesting a service from a government agency or organization may need to fill out relevant forms.

In summary, anyone who needs to provide specific information or apply for a specific service or benefit will likely encounter forms that need to be filled out following the proper procedure.

Fill

w8ben e generator

: Try Risk Free

People Also Ask about w8 ben e form generator

Do UK companies need a w8?

How you should complete W-8 forms is a must if you do business with the US. It's also a must if have investments in the US or earn income in the US. For example, you tubers, sole traders, UK resident companies, Individual taxpayers, will all come under these rules.

Who needs to fill out a w8ben form?

Form W-8BEN is required to be filed with withholding agents, payers, and FFIs by non-resident alien individuals who may be subject to withholding of U.S. taxes at a 30% tax rate on payment amounts received from U.S. sources, regardless of their ability to claim a withholding exemption.

What is the difference between irs form W-8BEN and W-8BEN-E?

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income.

What is a w8ben form for UK citizens?

The W-8BEN form lets you benefit from the US Internal Revenue Service (IRS) treaty rate with the UK. This lowers the withholding tax for qualifying dividends and interest from US shares from 30% to 15%.

What is a w8ben form for UK residents?

The W-8BEN form lets you benefit from the US Internal Revenue Service (IRS) treaty rate with the UK. This lowers the withholding tax for qualifying dividends and interest from US shares from 30% to 15%.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

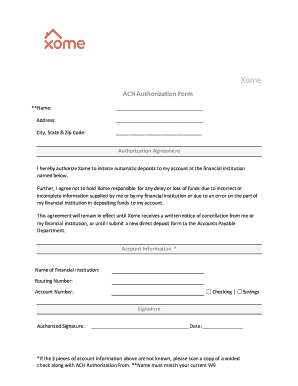

How can I send w8 bene form for eSignature?

When you're ready to share your wben form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my w8 form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your w 8ben form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit w 8 ben on an iOS device?

Create, modify, and share w8 tax form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is blank form w?

Blank Form W, also known as IRS Form W-2, is a tax form used to report wages paid to employees and the taxes withheld from them.

Who is required to file blank form w?

Employers are required to file Form W-2 for each employee to whom they have paid wages, tips, or other compensation during the tax year.

How to fill out blank form w?

To fill out Form W-2, employers must provide information such as the employee’s Social Security number, wages paid, taxes withheld, and employer information, ensuring accurate reporting.

What is the purpose of blank form w?

The purpose of Form W-2 is to report annual wages, tips, and other compensation paid to employees, as well as the federal, state, and local taxes withheld from those earnings.

What information must be reported on blank form w?

Form W-2 must report the employee's total wages and tips, Social Security wages, federal income tax withheld, Social Security tax withheld, Medicare tax withheld, and any other relevant compensation and deductions.

Fill out your w 8ben form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w8 Forms is not the form you're looking for?Search for another form here.

Keywords relevant to w8en form

Related to w ben

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.